One of common belief in the markets is that if you have to make large returns you need to find new stocks/hidden gems. Though true, but its not the only way to make returns.

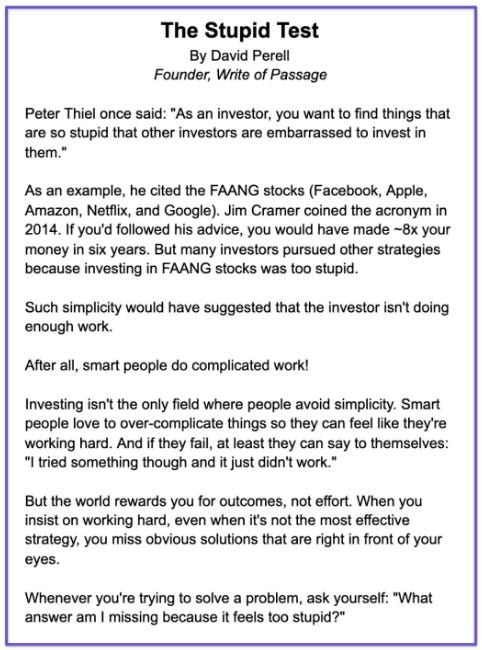

In the past I have shared the following snippet multiple times-

The above thoughts make a lot of sense and the best example that comes to my mind is that of Warren Buffett’s investment in Apple.

Buffet’s first investment in Apple was sometime in 2016 when the company was already one of the most known, tracked and larger companies. And still it has done exceedingly well as an investment.

Overtime having thought about why the above framework works (over & above the thoughts already mentioned in snippet), I have realized that no matter how known or well tracked a company is, market’s discounting for a stock’s above average growth period is limited.

So, if a well-known company has historically grown at a decent rate of say 20%, market will typically only discount this high growth for say next three or five years in the future post which it discounts that the high growth will fall to say a normal GDP growth.

And this is where things get interesting, if the company is able to deliver &/or convince the market that it will be able to grow at its current above avg. growth rate even beyond the limited time period that market is discounting, that is when the market bids up the stock.

A good example in the Indian context is that of Bajaj Finance; even back in 2014-2015 or 2016, Bajaj Finance as a stock was well known, tracked and had an established growth trajectory of 35-40% and thus ideally market should have discounted the future growth and thus there should not have been much upside left from those levels.

But that was not the case, Bajaj has been more than a 10 bagger from those levels. And this has been on the back of its ability to continue to grow at those high growth rates not just for next 2-4 years but much beyond that.

So essentially, in well known & tracked companies, returns are made not by knowing more about a company, that market & institutions will always do a better job than most people; but its about knowing better & thinking longer and building a better conviction that above avg. growth will sustain for much longer than next 3-5 years.

Another pattern that works for such stocks is when due to some temporary challenges, the growth of a known & tracked company reduces below its historic growth rate. In such cases, there is a major valuation de-rating for the stock given that earlier the market was building in X% of growth for say next 3-5 years and then a slowdown, but with recent slowdown, it starts believing that the new growth rate for next 3-5 years is this new lower growth rate that it has delivered in the recent times.

And if the company is then if able to get back to its old growth rate of X%, then there is a good re-rating and thus strong returns are generated by a known & well tracked stock.

A good example here again is Bajaj Finance, wherein over last 2-years, market started believing that it is no longer a 35% growth franchise and now it is a 25% growth franchise and thus the stock has seen a major de-rating. But overtime the company has re-gained its growth rates such that in Q3FY24, it has come back to its old growth rate of 35%.

I am personally of the opinion that with 1-2 more quarters of such growth, the market will again start building in 35% growth for the company for the foreseeable future and thus the stock will see good re-rating.

Another example here could be that of HDFC Bank wherein post-merger the bank has been facing some challenges and the market is now started building in much lower growth rate, ROE & NIMs for the bank vs its historic numbers; market no longer believes that HDFC is a 20% growth franchise. And thus, the stock is trading at valuation levels last seen in 2008-2009 lows.

There will come a time when HDFC will be able to address some of these challenges and possibly get back to its earlier growth & other metrics, which is when one could witness one of the largest, well known & tracked company deliver strong returns.

I’ll end this post by saying that what is more sexy that High Growth in Short Term is Medium Growth over an Extended Time Period.

That’s it for this week, new insight coming up next week. So stayed tuned!