Weekly Insights #36- Faced with Poor Accounting in a Company? Here’s What to Do

Investing experience from Control Print, RACL Geartech and Aditya Vision

In everyone’s learning journey in Investing, one important aspect that always comes to light is around accounting and the need to do some kind of forensic accounting to weed out bad companies. One also comes across case studies that show how frauds could have been discovered through forensic accounting (though rare & mostly backed by hindsight benefit).

My own journey in fundamental investing started with a data-oriented approach focused on numbers & forensics. And it was because of two reasons;

first, being a Chartered Accountant accounting & numbers seemed like an area I could excel at

secondly, my very first professional role was at Moneylife as a research analyst and Moneylife’s background & culture of investigative journalism further amplified the inclination towards finding out if something did not add up.

My very first major discovery came with the company- Control Print. Though everything around the company was good, there was a key issue around poor cashflows and recurring discrepancies in book value of inventory & physical stock being highlighted by auditors, leading to inventory write-offs.

I wrote about this in an article- Control Print: Sailing Smoothly, but with a Hole; which caused a bit of stir such that one large fund manager reached out seeking details on what else I have found; even company’s CFO reached out trying to explain.

At that time as a newbie analyst, it felt kind of an accomplishment finding something like this; but overtime when I looked back, I realized that finding such negative added no value to me, what could have added value would have been finding out something great about a company and benefitting from it by investing in it.

My 2nd instance of a negative accounting situation came in 2021 with RACL Geartech. Here again everything checked out well, the business looked great, but there was an issue of poor operating cashflows. When I tried to figure out where the cashflows was getting stuck, I came across a major error in company’s cashflow statement.

The company was adding back taxes paid into CFO and thus even the reported cashflows (which was already poor) were inflated.

This prevented me from investing as I felt that buying into a small cap with poor cashflows & accounting issues is the worst mistake an investor can make.

But it was sometime later when in one of the podcasts- Mr. Aayush Mittal stated that in smallcaps, accounting is something that improves overtime as the company becomes bigger and thus one has to give some slack on accounting initially if rest everything checks out.

This was a major learning for me given that it was coming from someone who has primarily invested in smallcaps for decades. This led me to invest in RACL (though at a substantially higher price than I 1st discovered it).

And a year later or so, the company did fix this issue with its cashflow accounting.

The learning that I have had over the years from my own experience & also learning from the experiences of others is that, one should not ignore an idea just because of few inconsistencies with accounting and not to get anchored to the whole concept of forensic accounting; a better approach is-

be aware of the deficiencies & inconsistencies.

Sometime back we had shared this post- How to Go About Researching a Stock; wherein we had highlighted the importance of a research bank; and creating a research bank goes a long way in figuring out such deficiencies & inconsistencies.Track how the accounting changes overtime for corrections in deficiencies & inconsistencies.

If possible, try to bring your discovery to the managements. If the management is honest, they will quickly acknowledge it and fix it; while others will try to play down the issue with some elaborate explanation.

This is not to say that forensic accounting is useless or following the above approach takes care of the risk; there will be times when you will get burned in situations wherein you end up giving some slack to a company even after knowing the issues.

But ask any experienced investor, they will always tell you that the cost of error of omission is much higher than the cost of error of commission ie. more money is lost not buying into a great opportunity than buying into a bad opportunity.

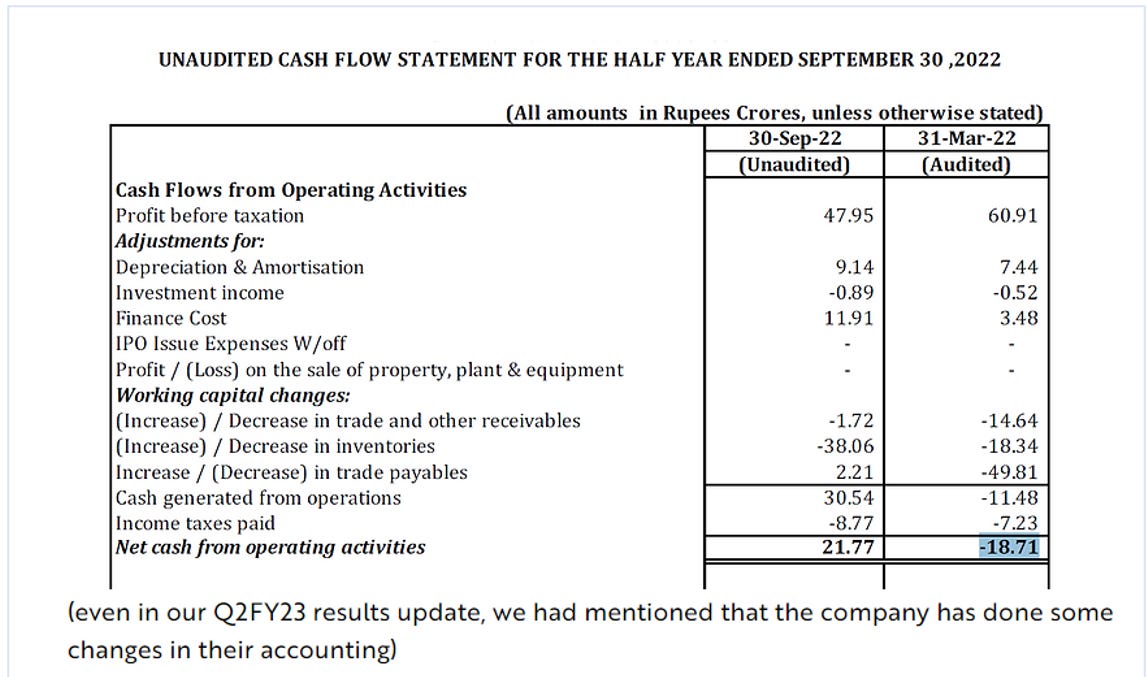

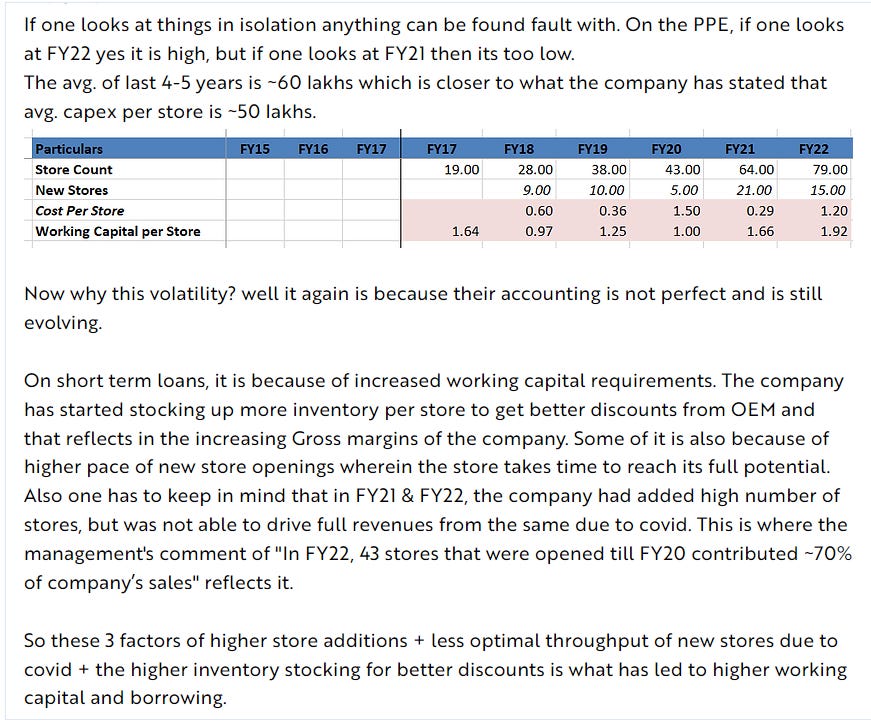

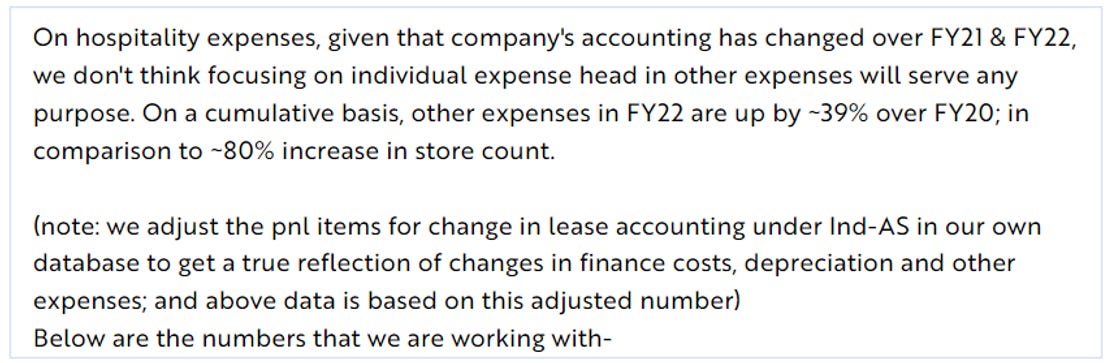

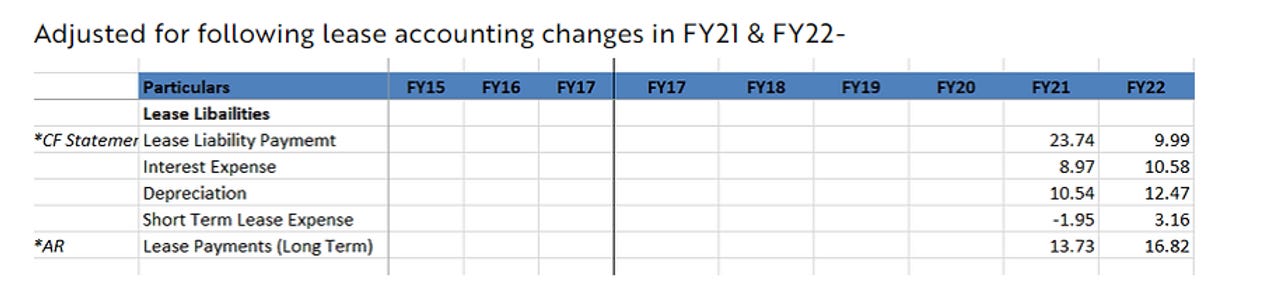

We faced another situation in April 2023, wherein some accounting issues were brought to light for one of our investment- Aditya Vision

We were highly surprised to see market’s reaction & most investors being caught off guard to this revelation; because if any investor would have gone through even one balancesheet & cashflows statement of the company, they would know that there are multiple deficiencies & inconsistencies with the company’s accounting.

Our experience that I have shared above helped us to hold onto our investment in the company as;

We were already aware of these issues with accounting.

Directionally we had already seen improvement in the company’s accounting; a lot of the issues pointed out where already corrected in company’s H1FY23 results.

Following are some snippets from the clarification we provided to our members back when this issue emerged-

Hope this learning and approach would help readers when faced with similar kind of situations in the future.

That’s it for this week, new insight coming up next week. So stayed tuned!