Sometime back we had written about this Formula for Exponential Returns in Lending Stocks, wherein we had highlighted how having a growth rate higher than ROE and a high valuation multiple is the best combination in lending stocks.

Recently we were looking into newly listed SBFC Finance; the high growth rate of >40% attracted us here. But after taking an over view of key metrics, something seemed off.

And it was the low ROE of the business despite having a decent ROA. This is not the first time we have seen such a situation, most of the recently listed high growth NBFCs like some affordable housing finance companies (Home First, Aptus) or SBFC’s peer- Five Star Finance, all have similar issue of low ROE despite having strong ROAs.

This is because of the relatively low leverage (high equity capitalization) that these companies have. And though high capitalization is a good thing for a lending business as it provides safety, but at the same time it is actually an overhang for stock returns.

See lending businesses are valued on a multiple of book value and thus more than the growth in loan book, it’s the growth in the book value (net worth/equity) that is needed for a stock to go higher.

Growth in book value is represented by ROE and as highlighted in the Magic Formula post, one does not necessarily need a very high ROE, even a decent ROE with look book growth being higher than ROE and an ability to raise capital at high valuation can do the trick.

But what if a lender is in a situation wherein, though the loan book growth is very high, but the ROE is extremely low due to a very low leverage (ie. high capitalization), and because of already being at a low leverage, it cannot dilute or raise capital in the foreseeable future?

This is exactly the situation in which SBFC Finance is in.

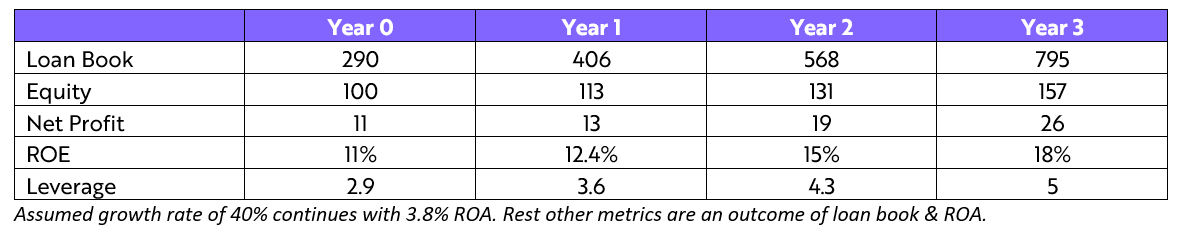

Following are SBFC’s key stats-

Growth rate >40%

ROA of 3.8%

Leverage ratio of 2.9x

ROE of 11%

The following table lays out a broad growth path for book value over next 3-years based on above stats;

So even though the loan book growth is 40%, the growth in book value is just ~16% CAGR over next 3-years. Even if we assume that the ROA improves from current 3.8% to ~5% over next 3-years, still the growth in book value would be ~20% CAGR.

So essentially what you have is a 15-20% growth opportunity that too at a relatively rich valuation of 3.8x book value; and not some very high growth opportunity.

The only way the growth in book value could be higher if the company raises equity capital, the possibility of which is low given that unless they improve their leverage, the ROEs will never expand and stay at current low levels. And ROE is one of the most important metrics for everyone, be it the lender itself, be it the provider of equity capital and also for the market in terms of providing a valuation multiple.

We believe that the current rich multiple given by the market is sort of discounting & building in the expectation of improved ROEs over time as the leverage increases, which if does not play out could have an impact on valuations here.

And we see a similar challenge in other names like Five Star, Aptus and Home First wherein growth & ROAs are very strong, but the ROE and leverage are relatively lower and thus there would be a big divergence between loan book growth and book value growth; while all trade at relatively rich valuations. Though the level of this issue for these stocks is much lower than what it is for SBFC.

In summary, this combination of High Growth + High ROA and Low Leverage + Low ROE is opposite of the exponential growth formula we had discussed earlier. In such combination, there is an overhang on stock returns vs a catalyst for stock returns in case of exponential combination.

That’s it for this week, new insight coming up next week. So stayed tuned!

What you have assumed is an ideal world where the management is capable of underwriting where they dont make bad loans. Didnt PNBHFC, Indiabulls Hsg blow it up? I am not even talking about DHFL. Any day a lower leverage is better. There are other components to improving ROE. A good lender should try to use it. But being a commodity business, contributions from other components cant be too high. A few examples here and there e.g IDFC first bank have high NIMs which can translate into higher profits and hence higher ROEs etc. Idfc first has its own issues. I was just giving an example.