Recently there was a good discussion on Twitter around whether to sell purely because of high valuations.

In this post I’ll share some more thoughts on this topic over & above what I had shared on Twitter.

If one goes through that discussion, one thing is very clear that we have countless examples on both side of argument;

On one hand investors have sold or avoided buying into something purely due to high valuations and then missed out on the future gains.

While on the other hand, investors have held onto stocks or bought stocks at high valuations and faced large losses.

So, the first thing that is clear is that one cannot have a straight forward rule that high absolute valuation multiple is a clear avoid & sell.

The second thing that I want to highlight here is that all the examples highlighted in the Twitter discussion to an extent rely on the benefit of hindsight wherein its is relatively easy to point out that it worked in XYZ stock and it did not work in ABC stock.

Whereas making decisions in the present scenario is as difficult as it is easy to make a case based on hindsight.

Recently I read this interesting post by Morgan Housel on - The Thin Line Between Bold and Reckless.

There he shares this very interesting insight-

And if we think about it, in most of the past examples discussed or highlighted, there was a thin line wherein things could have worked & vice versa.

Consider the example of IEX; IEX is an example wherein after reaching very high valuations of 90x, the stock has seen sharp correction. However, anyone who has tracked IEX would know that, these high valuations were a result of very high growth of 40-50% that IEX was reporting, plus the expectation of implementation of MBED in near term, which would have led to volume jump of 5-10x and thus even a 90x multiple would look cheap.

Instead, the opposite played out, MBED did not got implemented and even the organic traction got stalled due to shortage of power & rising power prices.

So, though IEX is now a case study of failure on account of high valuations, it could instead have been a case study of success even after high valuation. And same will be true for many other examples wherein there was a thin line between their eventual success & failure from a high valuation stage.

So, what is important is figuring out the pattern around why it works & why it does not, rather than focusing too much on examples.

And according to me, there are two things that leads to high absolute valuation multiples, sustains it and can further improve on it-

A. High Growth Rate

I am a stark believer of a view that high topline growth can take care of a lot of other issues in a stock, including valuations.

Market for a large part is simply discounting the growth that a company can deliver in near-medium term. If a company is delivering high growth and market is able to believe that this high growth will continue in near-medium term, it will discount that future growth upfront and that will reflect in the high current valuation multiples.

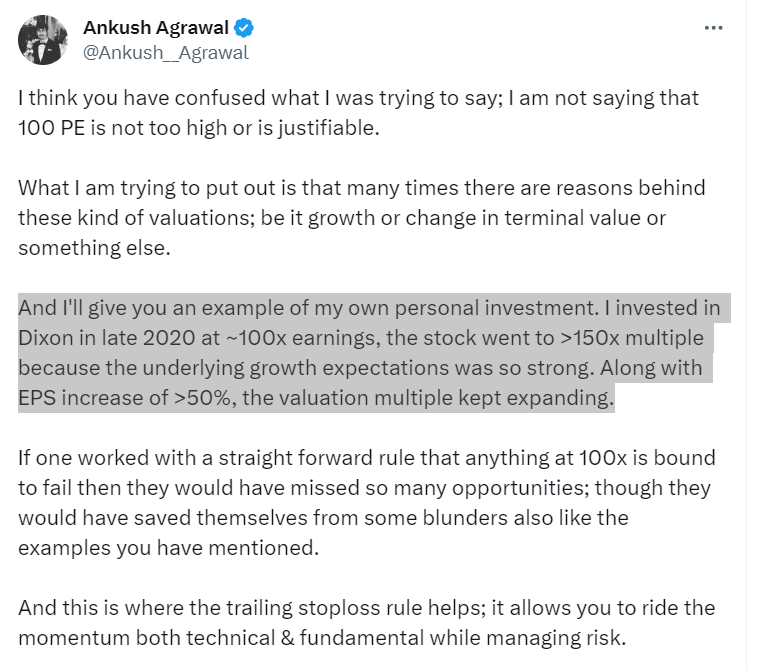

Dixon is an example that I had highlighted in Twitter discussion, wherein purely based on expectations of high growth due to the PLI schemes, the stock not only traded at high valuations multiples, but also saw further re-rating

We can see something similar play out currently in all the order book stocks like defence, railways etc. The underlying growth & expectation of growth is so strong that these companies are trading at 70-80x multiples. And if growth continues, even this 70-80x multiple will seem low on 1-2 year forward earnings.

B. Terminal Value & Risk Factor

Terminal value is nothing but the growth rate (including longevity of that growth rate) that the stock can deliver beyond the near-medium term that the market is currently discounting.

Alcohol companies have some of the highest absolute multiples despite various issues of slow growth, poor margins, heighted regulatory interventions etc. This is because the terminal growth rate & longevity of these companies & brands is among the highest across businesses.

Same is the case with various FMCG companies like HUL & Nestle, they don’t have some high growth rate, but the sheer fact that they will continue with this growth rate for very long, results in such high valuation multiples for them.

So, if a company can prove its relevance & that it will continue to grow at a certain rate beyond medium term, then market does accounts for that in the valuations of the company.

High growth rate in near term is over-rated & over-discounted by the markets; whereas slow & consistent growth over an extremely long period is under-rated & under-discounted by the markets.

One of the best insights around why valuations expand to some very high levels & sustain is something that Mr. Samit Vartak of SageOne talks about. He highlights that over time as a company grows in size and build’s a consistent track record of growth, the risk factor associated with that stock reduces and thus it starts attracting a very different set of investors who are more risk averse and are ready to accept a lower IRR in return for this lower risk. And because their expected IRR is low, they are ready to pay higher valuations for these stocks and this is why valuations for companies expands overtime.

There are few other smaller attributes as well like ROCE (capital efficiencies) that market considers in determining valuations; but growth (near-medium term) and terminal value (growth beyond medium term) is what drives most of it.

One important thing to understand here is that growth rate led high valuations is more cyclical in nature, in the sense that companies can go through short term periods of high growth rates and thus during this high growth period their valuations can expand materially, but as soon as the growth rate slows down, the valuations do take a big knock.

And this is where the biggest risk emerges in buying stocks at high valuations, you cannot go wrong on the growth. If growth falters, then you will see material compression in valuation multiple.

On the other hand, high valuations attained on the back of terminal value & low risk factor is more sustainable. It is something that is not easily attained by companies, but once achieved, it sustains for long.

And thus, the highest valuations in the markets are reserved for stocks that has all the three factors of high growth, terminal value and low risk.

Some of the stocks like Bajaj Finance, Dmart, Trent, Titan, Astral etc are some examples here.

There was an interesting comment in the Twitter discussion that we as investors often anchor ourselves too much on the examples of these select names that trades at very high valuations; and this is very true.

But the other side of this is the fact that these stock where not born with these kind of valuation levels, it is something they acquired over the years on the back of consistent track record of high growth. And thus, there is a path for more companies to get to that level.

So, there is a possibility that a company that is currently trading at high valuations might go on to join this pack of select group of companies whose example we all highlight. If a company can show large opportunity size, leadership, continued & sustained strong growth then why not?

Now let’s discuss some hacks that helps in decision making when faced with such a situation of high valuations-

A. Invert

Charlie Munger often says “Invert, always invert, Turn a situation or problem upside down”.

Inversion works exceptionally well when faced with situation of high valuations. I have explained this with the example of how I exited Dixon in the following webinar; watch from 48:15 – 49:51

B. Use Trailing Stop Loss

Every now & then you will face a situation wherein valuations look too rich and thus one thinks of exiting the stock, but at the same time the underlying momentum both in fundamentals & stock price is also strong.

In such situations, using a trailing Stop loss works well such that once you decide that the current price fairly reflects the entire upside, you don’t exit immediately, but you use a trailing stop loss because one never knows where the underlying fundamental & stock price momentum will take the stock; and it also allows you to be in a position to benefit from any new positive development that might emerge.

So that’s broadly what I wanted to discuss here. As we head into Diwali week, we are offering 15% off on our comprehensive research services.

Use the following code on checkout- “DIWALI”. The offer is valid till 15th November.