This week has been tough for the markets and investors. The biggest question that everyone wants an answer to is whether it is a quick pullback or is it a start of a longer correction.

No one can have a definite answer to this, all we can have is a calculate guess based on understanding, signals & reasonings. And there are arguments to be made on both side;

On one side, the underlying growth in economy and stocks (especially small & midcaps) is very strong and thus we should expect a milder pullback; the fact that SEBI’s recent actions had some impact would also indicate a more technical sell-off.

On the other side, various signs like

sharp run-up over last 1-year

frothy valuation in some segments of the market

heavy distribution on the back of IPOs, QIPs and promoter selling

signals for a proper correction.

Though the actual outcome would only be known in hindsight, what will matter going ahead is the conviction, understanding and preparedness that one has around their investments, some basics of how things play out during a correction and what to do in a correction.

Any correction in the market is beyond our control, the only thing that is in our control is to ensure that -

We don’t carry a lot of risk going into a market correction- like high beta bets, positions wherein there is some uncertainty, very high concentration in individual positions and investments wherein we have lower conviction.

We ensure that our portfolio comes out stronger & prepared for the next cycle.

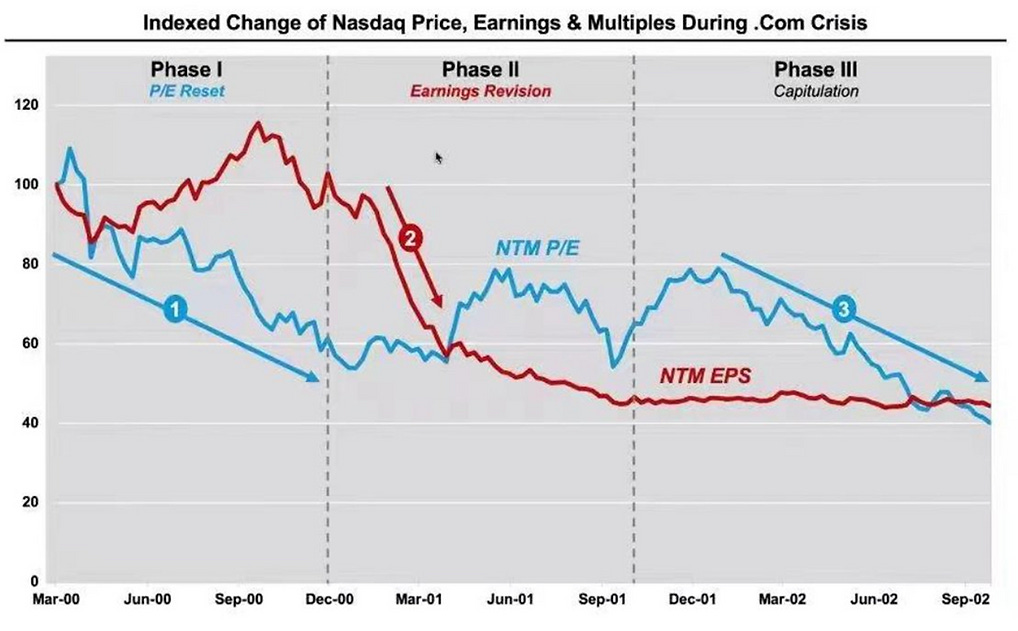

The following chart is the most simplest & actionable explanation of what happens during a correction-

Back in 2022, which was again a period of correction in the market, I had written a blog-post explaining these different phases of a correction, what should one look for in each of these phases and how to prepare portfolio for the new cycle.

One can read that post here-

https://www.surgecapital.in/post/market-correction-an-opportunity-in-disguise

Now this is my expectation is on how the market might shape up going ahead-

The correction does not seem to be a broad based one given that we don’t have an external economic shock, global markets are holding well and NIFTY is also holding up well.

The correction should largely be limited to certain segments especially small & midcaps and within them there would be different segments;

the smallest caps and SMEs should ideally go under sharper corrections as the froth in this segment had gone out of control.

A 2nd segment that should undergo decent correction would be stocks that went up much ahead of what their earnings & business quality justified simply because of the strong movement in the broader market. So now with valuations under pressure and not much earnings growth to compensate for the same, they would see a good correction.

3rd segment would be stocks wherein earnings growth has been strong and is expected to be strong, but valuations have run up much ahead and thus they will see more of a time correction till the earnings catch up.

(one thing to note is that earnings takes time to catch up whereas valuations adjusts very quickly, which is why in the initial phase of market corrections, even these stocks will see a decent correction.)

Another segment that also takes a significant beating is one wherein till now the earnings growth has been strong and thus valuations are also rich. But for some reason the growth takes a U-turn and thus the price takes a dual impact of fall in earnings & fall in valuations.

This I have seen happen in stocks that were being driven by some external theme and that theme just stops playing out. It has always surprised me how the timing of market correction is so damn perfect with the downturn in such stocks. These are typically the most dominant theme of the current bull run.

(Pharma till 2015, NBFCs in 2017 are some good examples of this)

All of these combined is what will result in index level correction.

Stocks that will buck up the trend and do well would be ones that are still reasonably valued & would continue to display earnings growth and ones that would see acceleration in growth.

And finally, there would be new trends that will emerge from businesses that till now were not growing much but will deliver better growth going ahead.

So these are all the thoughts that I am currently working with and hope that readers would benefit some bit from what I have shared above; especially on how to read a correction and how to prepare for the same.